Our journey with NDIS had not finished. Even though the construction project did not go as smoothly as I had hoped for, I still believed in the concept and the good that was coming from the NDIS constructions.

There are quite a few funds available that offer investment into large projects (often spending many tens or even hundreds of Million Dollars). One of the ones we considered the most seriously is the Synergis Fund. It sounded very professional and reliable. The main reason we did not end up investing was the difficulty in actually talking with someone that is running (or even just selling it). There was no phone number and all of my email requests went unanswered.

Small and Personal

I had been following the offering and promotion that Kevin Nolan from Disability Homes had been sharing. While his homes that were comparable to ours seemed expensive, there was one that really stood out: A block of units with 4 apartments for people with special needs (plus one for the carer).

Not only would everyone have their own space (with a second bedroom, so they could have guests), but the shared facilities (e.g. overnight onsite carer) would reduce the costs for the participants.

The price was way beyond what we could afford, but a few months ago (after Kevin had heard the same thing from many other investors), he started offering a fund where investors could pool their funds to build and rent out four to six of these unit blocks.

Investing with Friends

I had been sharing what we were doing about investing and we had a couple of friends who were interested in similar impacts to us and also looking for investment possibilities.

So after the initial conversation, I had with Kevin about the fund, we set up a shared session with Kevin and Tim Baker from Boutique Capital (the trustee). Two of our investing friends joined and we grilled them with questions.

Afterwards, we were able to share thoughts and impressions and this gave me the confidence to go ahead. It was really interesting to hear how others think about investing and managing risk.

Direct Sustainability Impact

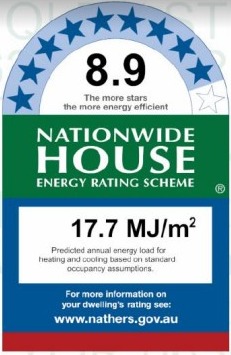

One of the great outcomes from this conversation was the energy efficiency improvements. Kevin was open and interested in our suggestions around energy efficiency and future-proofing the building with three-phase power into the garage for EV charging. He implemented these improvements quickly and superbly. Just a couple of days ago, we received confirmation that an 8.9-star rating was achieved.

This confirmed my vaguely held belief that it is much better to invest in smaller, more local projects. Here a few meetings created real change, we all learned something in the process and can celebrate our achievements together.

Caring for the Tenants

One other very strong reason for going with Kevin was the integrity that all participating parties displayed. NDISP is the SDA provider who has prepared the plans for these blocks of units. In my process of checking out Kevin, I rang NDISP and only heard the highest praise about him and how he understood what the tenants required.

As a voluntary measure, a portion of the government support is going back to the tenants so that they have an expanded budget. If I understand correctly, it is NDISP that introduced this measure. But it has Kevin’s full backing and for us as investors, it also felt good.

While Tim is not involved in looking after tenants, his care is in providing great value to members of the trusts he is a trustee of. With a background in finance, he has systemised the handling of smaller trusts and created a fee structure that makes this affordable for the trusts. His sharing touched me to the point that I want to run a fund, just so that I can work with him. We’ll see whether I can make that happen in the future.

A Robust Team

The same respect that exists between Kevin and Brett was also palpable between Kevin and Tim. So a great, well-rounded team that respects all members and communicates well, exactly what I had wished for after the construction project where this was lacking.

All parties are very experienced in exactly what they are offering and at the same time open for feedback and considering new angles.

Achieving the Impacts We Wanted to Have

Happy people:

I think the tenants will absolutely love these properties. Having their own home is a good start. The automation features are great and the energy efficiency is going to feel good and save them money.

Healthy people

I think I can write pretty much the same as for our other NDIS property: Living in a good environment within a real community is definitely healthier than living in an institution. This fund is making that possible.

Hopeful people

Even more than with the last property, having your own space is achieved beautifully with these properties.

Closing natural resource loops

This has not yet been part of our planning. But we want to get together with the other investors and brainstorm some more ideas about that.

Clean energy

Energy efficiency gets a big tick. The solar system is yet to come but already planned.

Biodiversity

These properties are on in-fill sites in the city. So no natural habitat gets destroyed. I’ll have to look at the garden plans to see whether they can be improved.

Conclusion

So far, every interaction was a joy. I hope that this will continue throughout the fund’s life.

I really like investing when I can talk to the people who are making it happen. It is so much more enjoyable and I feel invigorated by feeling that my thinking and input has an impact.

By the way, I did not write anything about returns, because they are only predictions at this point. I’ll report back on them when I have some actual performance figures (in a year or two).

Waiting in anticipation on your “report back on them when I have some actual performance figures (in a year or two)” and your overall view of this investment.