As an entrepreneur, I have always been excited about owning a business. For employees that is not necessarily the case. After actively working on employee ownership for the last two years, one of my big realisations is that cash is much more important to most employees.

The first reactions to my proposals were lukewarm at best. If anything, it was an interesting concept that had little to no meaning for my team members.

This changed when dividends started flowing. Suddenly, the ownership had an impact with regards to their cash flow. So here I am outlining a structure of team ownership, that makes it real for employees while at the same time being really beneficial for the entrepreneur.

How to Turn Company Ownership into Cash for Employees

The single best way is to distribute profits. That is the most direct experience and immediate benefit. I, therefore, try to have some cash reserves that are immediately available for distributions before implementing team ownership.

Naturally, that brings the question of why not just stick to a profit share structure. It is much easier to implement, it requires fewer explanations and less shared decision making. I would not underestimate the benefits of that.

Why I Prefer Employee Ownership

The two main reasons that I prefer employee ownership to a pure profit share structure are

- The real value is generated in a business as an asset and unlocked upon sale. This can be brought forward through team ownership

- Impacts from what we do today often manifest in 6 months, a year or more. So longer-term thinking and recurring small changes multiply the outcomes. Ownership rewards employees beyond them being part of the business. So even if they move on, their interests are aligned until the last moment and beyond.

Also, looking at any book on wealth: asset ownership, especially businesses, is always the number one priority, so there is no doubt in my mind that if we really want to let more people participate in wealth creation more equitably, business ownership is an essential step towards that.

Longterm Cash Impact

The other way to turn company ownership into cash is the ability to sell shares. Substantial and sustainable employee ownership precludes big exits, as they eliminate employee ownership (unless they involve shares in the acquiring company). Therefore, it is good to build the ability to sell shares into the employee ownership structure.

Avoiding Negative Cash Flow Impacts

I have only asked employees once whether they wanted to pay cash for more shares. And it was more as an afterthought of the main deal (which did not involve any cash outlay). I doubt I will even offer it at all in the future unless someone actively approaches me. Hardly anyone took it up.

In the first employee ownership structure, I lent the required funds to my employees. Part of the agreement was that repayments only had to be made through the distributions they received from the business. So it was risk-free to them and they would never owe me anything if the business failed.

There were two downsides:

- Employees were reluctant to take me up on this offer of letting them borrow money as they did not want to owe anything (even if it was completely risk- and interest-free)

- It created a lot of accounting admin headaches. I had to take care of all the different streams of distributions, loan repayments, etc. to many people.

While a loan like this might not have an actual negative cash flow impact, emotionally, it felt like it. Consequently, I structured the next deal very differently.

Using Loans Tax Effectively

For the school camp, I actually set up a new company that purchased the business from the previous owners (without buying any of the legal structures – which were family trusts).

This new company received a loan from me to enable it to purchase the relevant business assets.

It means that this loan can be repaid from a cash flow surplus without affecting my tax position. And I only have to manage a single loan. Much easier.

How to Turn Company Ownership into Cash for Entrepreneurs

We started with a random 5% ownership from day one. I wanted to choose something that had some meaning without giving away too much value before really knowing my new team. For a business valued at $1 Million, this is $50,000, so not too bad.

How could I give it to the employees without any tax impacts? We did this before the new entity started trading, so all it had were assets and pretty much the equivalent amount in liabilities (the loan), so a $0 value.

I defined a formula to value the shares (3 times net profit before tax, before team bonus and after-tax depreciation divided by the number of shares). While there is an outstanding loan, a specific portion of that (in our case annually about half) is repaid before the rest of the profits are offered in a bonus scheme.

It is optional to participate in the bonus scheme. 67% of the bonuses are used to make offers for shares (at the price calculated above). The rest is used to cover the applicable tax component for the team members.

All shareholders (that includes team members who already hold shares) can choose to sell a portion of their shares. Those that take it up, can sell based on the percentage of their holdings in the company. So if one person that owns 50% and another who owns 10% of shares want to sell shares, the first could sell 5 times as many shares as the second in this transaction.

If not enough shareholders are interested in selling, new shares will be generated. This is equivalent to everyone owning a slightly smaller piece of a bigger pie. The value of each share stays the same because the company effectively increases its equity (by the value of new shares created). It gives existing or retired team members a chance to cash out while allowing new team members to build their ownership in the company.

The last step is to calculate the tax liability for the company to make sure we can pay from cash flow when due, and to decide on and distribute dividends (after share changes are booked). This means that freshly minted shareholders receive an instant dividend to start creating that positive cash flow experience.

Figuring Out The Correct Profit Share to Distribute as Bonuses

In a traditional business, 100% of profits go to the entrepreneur. For a profitable business, they are rewarded with ongoing returns.

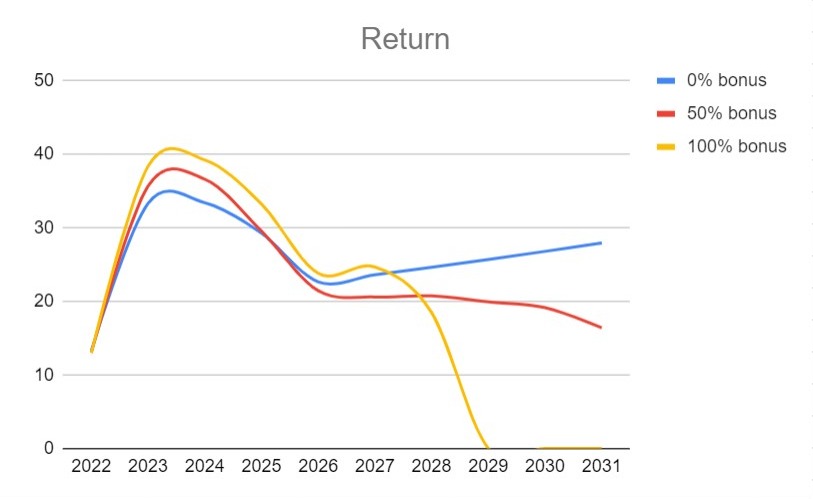

I played with many scenarios, but want to highlight 3. This shows the cash return for investor funds (after tax, but including the loan repayment in my specific example) over a 10-year period. The scenarios are where the bonus payment is 0%, 50% or 100% of profits. It assumes that 67% of bonuses are used to buy shares of the original investor.

The big spike in the first couple of years comes from the accelerated repayment of the loan. In the first 6 years, there is actually not too much of a difference between the 3 scenarios. The only outstanding thing is that the returns to the investor are the highest if 100% of profits are distributed as bonuses (see yellow line).

Why is that? Because more shares get purchased more quickly, instead of being distributed as cash dividends.

The downside is of course, that the return also ends more quickly (in year 8) when all the shares have been bought by the team and the original entrepreneur has no shares left.

Looking at the blue line, the returns keep increasing if nothing is shared with the team, but it is only in year 6 that this actually has a more positive cash flow impact for the investor than the 100% bonus offer.

A Personal Choice

Naturally, it depends on a lot of different things in your own life and your own preferences. For me, I love the initial years of building a business. I feel that I have the greatest impact and the most fun in working new things out. That is why naturally, I would prefer the 100% bonus pathway with a predictable end of my involvement.

I have chosen the 50% bonus for the school camp, as it creates cash flow for the team from the first year, rather than it all being theoretical for many years.

Tax Impacts

Without going anywhere near tax advice, I have always found that capital gains were taxed much more favourably compared to income. This structure of employee ownership delivers a large portion of returns as capital gains and distributes the income portion over many employees. With franking credits in Australia, the tax burden is reduced even further for all individuals.

Conclusion

This is a true win-win-win-win situation.

Society wins because more people own income-producing assets in a more equal share.

The individual employee wins because they are rewarded better for the value they are creating.

The entrepreneur wins because they are cashing out over time, rather than waiting and hoping for the big cash-out at the end of their lives.

And the tax office also wins, because tax is paid on business income and additional capital gains, which otherwise might have been locked up in a founder-owned business for years.

So I hope to inspire many baby boomers who are thinking about retiring to contemplate structures that lead to team ownership. If I can offer any assistance in working it out for your specific situation, please let me know.